Q: All my contracts need to pay stamp tax?

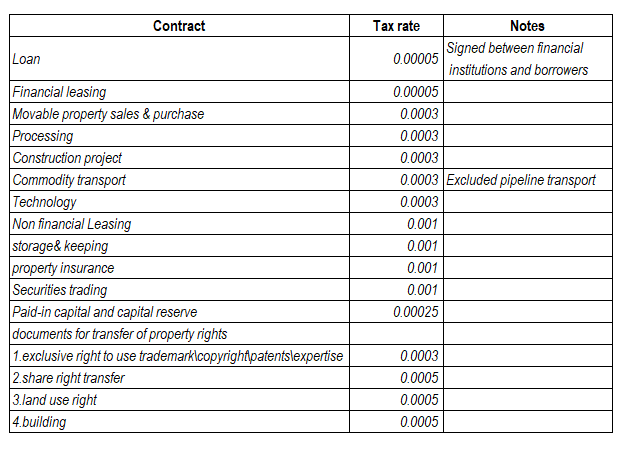

R: No, only the contracts listed in the Stamp Tax Act need to pay stamp tax. The detail and related stamp tax rates as below.

Q: If doing above business but not sign contracts, then my company can exempt to pay the stamp tax?

R: No, there is a substantial stamp taxable contractual act, then has the responsibility to pay the stamp tax.

Certainly, when temporary preferential stamp tax policies issued, the company can enjoy the benefit.

Reminder: According to the Stamp Tax Act, the base for calculation the taxable contract stamp tax shall be the contract amount excludes the VAT clearly specified in the contract. Please list the VAT amount separately in the contract, when you sign taxable agreement, to save the stamp tax.

Please contact us with any enquiries

wcx@ruanyinchina.com

www.ruanyinchina.com

+86 021 6049 2821

+86 189 1629 8482