Why we need to get Chinese fapiao for our purchase or issue Chinese fapiao for our sales in China?

At present, China tax collection and management is based on the fapiao not cash flow or Purchase/sales agreement. So each transaction firstly needs to get Chinese fapiao and keep them careful in case tax office review. That does not mean tax office doesn’t care about cash flow or purchase/sales agreement. They concern the substance of the transaction. So besides of fapiao, the company’s cash flow and purchase/sales agreement also need to be kept well as the additional supporting documents. The subject of fapiao issued, purchase/ sales agreement signed and payment made should be a same one.

Please note that:

-

Even have not received the payment from a certain client, if the company already issued fapiao to this client, then have a responsibility to pay VAT then.

-

Even have not made the payment to a supplier, if the company already got VAT special fapiao from this supplier, then can use it to deduct sales VAT if the company's nature is general VAT taxpayer. It is the reason why many companies want to get VAT special fapiao as sooner as possible.

-

Even download E-fapiao , the company still needs to print one in paper according to present regulation.

How to get my company’s blank fapiao to issue fapiao to our clients?

Most blank fapiao(s) are directly bought from China tax bureau, it is very convenient to get from tax office;

What we need to provide to suppliers when they issue fapiao to us?

To issue or get a VAT special fapiao needs below information:

-

Company’s fully Chinese name

-

Company’s unified social credit code

-

Company’s address and contact tel.

-

Company’s bank account and account No.

For Non-VAT special fapiao issuing, 1 and 2 info. are enough. Most these information, the company can get from the company’s business license and bank information paper. As the company will enquire many vendors to issue fapiao in many times, please keep the company’s fapiao information in electronic record. The company's clients’ fapiao information will be saved in the fapiao issuing system after fapiao issued, so if no special purpose, the company doesn’t need to save client's info. separately.

What content we need to check when get the fapiao from suppliers?

When the company gets a fapiao from a supplier, please check all the items in fapiao whether are correct. Especially the company's name & unified credit code No. , goods/service description, tax rate and total amount, the type of the fapiao( VAT special fapiao, Non VAT special fapiao).

What are the common fapiaos in China?

-

Tickets

1) Railway ticket

2) Flight ticket

3) Intercity ticket

4) Other passenger transport tickets.

-

Small fapiao (like metro fapiao, taxi fapiao...)

-

VAT fapiao

A. Paper fapiao

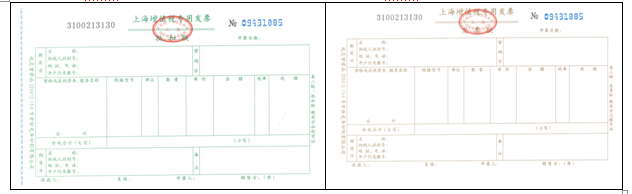

1) VAT special fapiao as below: we can get two pages like below for each one fapiao (same fapiao number).

2) Non-VAT special fapiao as below: we can get one page for each one fapiao.

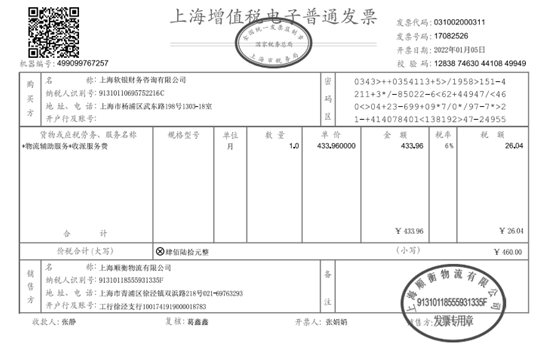

B. E-fapiao which is electronic fapiao printed it for bookkeeping and expense reimbursement.

#Why We Need to Get Chinese Fapiao#Chinese fapiao# Invoice in China